Everything your loyalty program needs to link program performance to your CFO's view of enterprise value, and supercharge your segmentation and targeting strategies

Many of your finance colleagues are focus on minimizing redemption costs rather than maximizing value, making it very difficult to get them to invest more in loyalty.

Unfortunately, many people view loyalty programs as cost centers, which can often become a barrier to making progress against your goals.

It's common for those that view loyalty as a cost center to push for program devaluations, which you know will have detrimental impacts on member loyalty.

Loyalty is a long game; The benefits of these programs comes from retention improvements compounding over many future periods. Unfortunately, the long term nature makes it very difficult to quantify.

It's difficult to get the CFO to invest more in the program if you can't tie it directly to their definition of enterprise value creation.

Once you figure out how to tie the program to enterprise value creation, the next logical question is how to I use the program to maximize enterprise value creation?

CLV models give program managers the ability to assess long term cost/benefit trade-offs, leading to better business cases and enterprise value creation.

Everything you need to predict and maximize Customer Lifetime Value (CLV)

-1.png)

Specialized Actuarial Expertise We are the only actuarial firm globally that solely focuses on loyalty programs. Our team's intense focuses in this area for over a decade gives us a unique expertise that is unmatched in the industry.

Unparalleled accuracy A decade of trial and error has enabled us to understand what works and what doesn't. We've leveraged this expertise to build proprietary actuarial algorithms and tools allow us to provide the most accurate CLV Estimates.

Designed for Business Insights Our extensive expertise allows us to design our models to anticipate and address the nuanced questions and concerns from all stakeholders, helping our clients better assess and articulate how CLV influences the business.

.webp)

CLV Net of Redemption Costs Our proprietary models predict CLV net of expected redemption costs so that you can properly weight long term cost/benefit trade-offs.

Link to CFO's View of Enterprise Value Our proprietary CLV Framework allows us to link the program to the CFO's view of enterprise value, helping to convert a key stakeholder to an advocate.

-1.webp)

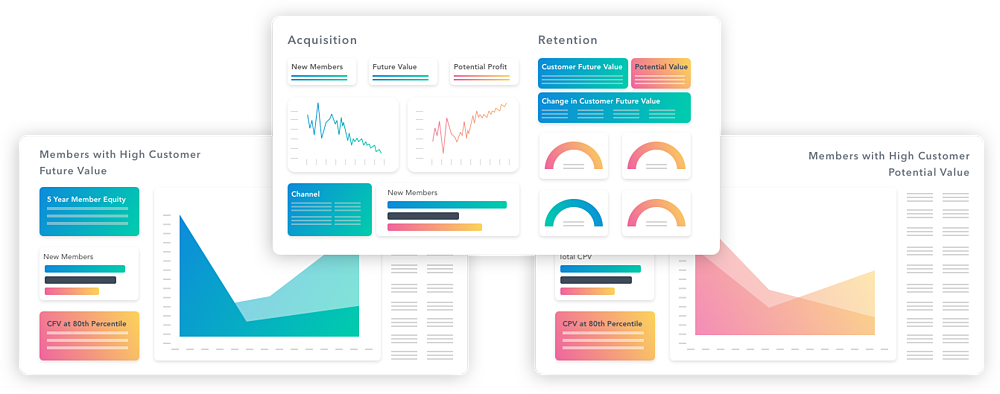

Dashboards Online self-service dashboards so you can answer your own questions about CLV, long term profitability and enterprise value creation.

Scenario Testing Tools A toolbox to easily scenario test different business decisions and program strategies and their impact on CLV so you can confidently identify the right decision.

KYROS Optimizer A tool to continually uncover new opportunities to maximize CLV, creating enterprise value that your CFO will love

Scored Datasets Actuarial predictions of future behavior for each member that can be used by your data science and analytics team to supercharge their analyses.

All loyalty programs have the actuarial problem of predicting redemption costs.

Programs issue points today, but won't know the actual cost of those points for years.

How does a program leader make sound business decisions today without knowing the most important expense of the business model?

KYROS can help. Check out our Pricing Page to learn more.

Trusted by major industry leaders, KYROS is the only actuarial firm in the world that focuses solely on loyalty programs.

KYROS built sophisticated predictive models to help us test scenarios for significant changes to our global, multi-brand loyalty program. Their niche expertise in loyalty finance is extensive and highly recommended for any loyalty program CFO.

—Andrew Boshoff, CFO, Global Hotel Alliance

Learning how different enhancements could affect Customer Lifetime Value and program profitability intrigued us. We now look at decisions through a CLV lens to benefit our program and its members.

—Juan Pastrana, CEO, Club Premier, Aeromexico's Frequent Flyer Program

KYROS expertise in breakage analytics and liability management has been incredibly helpful for us

—Fahad Munif, Samsung Rewards

In my business, I've maintained a specialty in the area of loyalty program finance and program performance reviews. No one knows liability management better than the team at KYROS.

—Bill Hanifin, CEO and Managing Editor at The Wise Marketer, CEO at Hanifin Loyalty

Robust liability management forecasting often means the difference between millions made and millions lost. KYROS are leaders in the loyalty finance field.

—Mark Ross-Smith, CEO, Loyalty Data Co & Editor at Travel Data Daily

The Loyalty Academy continually seeks to add courseware focused on advanced topics in customer engagement and loyalty. We are proud to have partnered with Len Llaguno at Kyros Insights to create these courses.

—Mike Capizzi, Dean of Education, Loyalty Academy, a Wise Marketer product

KYROS has been instrumental in supporting our clients with highly specialized liability management expertise

—Evert deBoer, Managing Partner, On Point Loyalty

As actuaries, KYROS are uniquely placed to enable clever liability management that can make a huge difference to the financial impact of a program

—Phil Gunter, Founder, New World Loyalty

KYROS Insights proven knowledge and expertise in liability planning, evaluation and modeling is an essential service solution that any loyalty program entity should consider employing and over time will realize a more accurate picture to inform P&L.

—David Slavic, Co-Founder, Ascendant Loyalty Marketing