Loyalty programs are far from a new concept. If we dig deep enough inside our wallet, most of us will likely find an old, tattered punch card … just in case an opportunity presents itself to finally cash in for that free sandwich.

While many of these programs may look different today — think instant digital redemptions — the original loyalty program value proposition remains: in exchange for repeat business with a brand, loyal customers are given opportunities to earn rewards. Customers tend to recognize the value of these rewards, which helps explain why more than half say they will join a loyalty or VIP program.

Most business leaders also understand the value of loyalty programs, at least in theory. Nearly anyone can tell you that it costs more to acquire a new customer — five to 25 times more, depending on who you ask — than to keep an existing one, and loyal customers tend to spend more with a brand than new customers. In other words, building a loyal customer base should have a significant impact on a firm’s bottom line and stock price over time.

In practice, however, many loyalty finance and marketing professionals have difficulty quantifying this impact, which makes it hard to prove that a loyalty program is indeed creating value. Fortunately, most companies already have the necessary data to measure loyalty program value with more precision. When the data is used more effectively, it becomes possible to communicate program value to your company’s stakeholders in a language everyone understands.

In any company, the finance team is responsible for measuring financial performance and identifying ways to maximize firm value through financial planning and investment decisions. Since loyalty programs directly influence company value, finance teams can benefit from concrete data and methods that allow them to make better decisions.

One of the most common methods for quantifying firm value is the discounted cash flow (DCF) approach, which says that a company’s value is the present value of its expected future cash flows. Of course, the more predictable a firm’s future cash flows, the more credible the present value calculation.

Some business models have more predictable cash flows than others (subscription-based models in which customers periodically pay a predetermined fee is a prime example). Businesses with active, healthy loyalty programs also provide a wealth of insight into a company’s future cash flow. Why? Because most of their future cash flow comes from current program members.

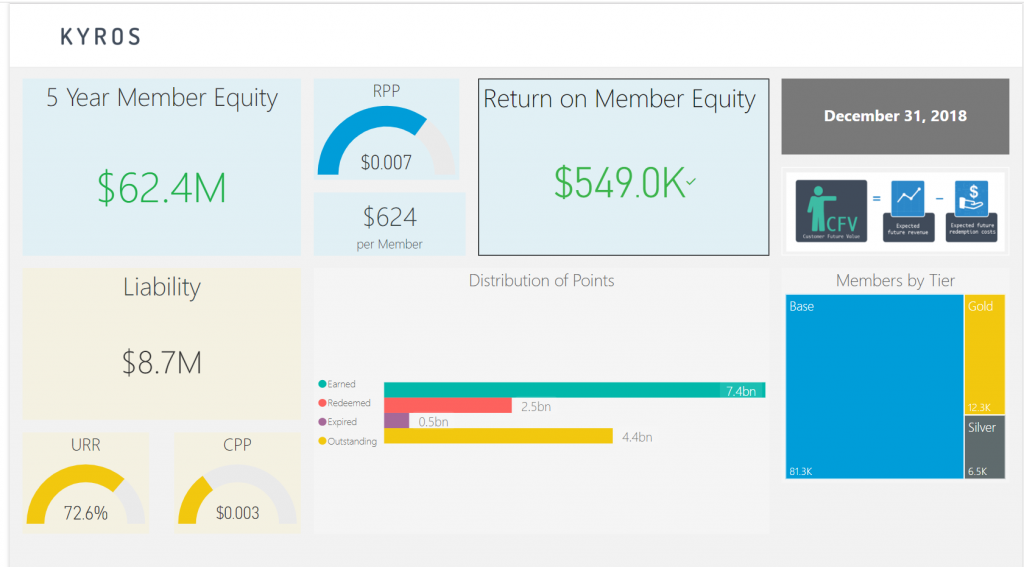

Taking a step back for a moment, let’s see why the relationship between loyalty program member behavior and a company’s future cash flow holds true. You can apply a DCF-like model to measure the value of a loyalty program by estimating customer future value (CFV), which is the present value of estimated future free cash flow produced by each program member — more precisely, expected future revenues less expected future costs. Summing CFV across all loyalty program members gives you the present value of your program members, also known as member equity.

The Pareto Principle states that on average, roughly 20% of a business’s customers account for 80% of its revenues. While the actual breakdown varies depending on your business model, your most loyal customers always account for most of your future free cash flow.

Therefore, member equity is a good proxy for a large share of the value of your entire organization. And, if customer behavior influences member equity, you can increase organizational value by focusing on the relatively small segment of customers that drive company profits. This notion supports the use of customer-based corporate valuation (CBCV) models.

The underlying concept of the CBCV model is that unit economics is the number one determinant of lasting business success. Put differently, if customer retention and variable profitability are strong while customer acquisition costs remain low, a business is more likely to succeed long-term than it would with operational efficiencies alone. If you understand customer-level profitability dynamics, you can increase company value by investing in acquiring profitable customers and marketing strategies that influence their behavior.

The meal-kit delivery service Blue Apron is a great real-world example of how CBCV models can be used to understand and influence firm value. Although the idea of food delivered directly to your doorstep resonates with many consumers, subscription-based models like Blue Apron have not been as financially successful as food delivery services such as UberEats and GrubHub.

By digging deeper into the behavior of Blue Apron’s customer base, company management was able to see that their low customer retention rate combined with rising customer acquisition costs was eroding member equity. Unfortunately, this realization was ill-timed, as Blue Apron’s stock price had already fallen nearly 90 percent since its IPO in mid-2017 — an outcome that Dan McCarthy, a leading CBCV researcher, had predicted using his models. Nevertheless, these insights enabled Blue Apron to redirect firm resources to the portion of customers that drive value.

Since loyalty programs provide rich, member-specific transactional data, CBCV models are powerful tools for analyzing trends in customer behavior and diagnosing issues that limit profitability. This type of data analysis allows finance teams to show the loyalty program’s direct impact on organizational value and company stock price.

Since marketing teams are responsible for building and maintaining their company’s customer relationships, they typically lead both strategic and tactical loyalty program initiatives. One of the biggest mistakes companies make is focusing on the near-term cost of such initiatives rather than the long-term value they create. Over time, incremental value can be created even if costs rise. Companies that can quantify this cost-benefit trade-off can more readily determine whether their marketing efforts are successful.

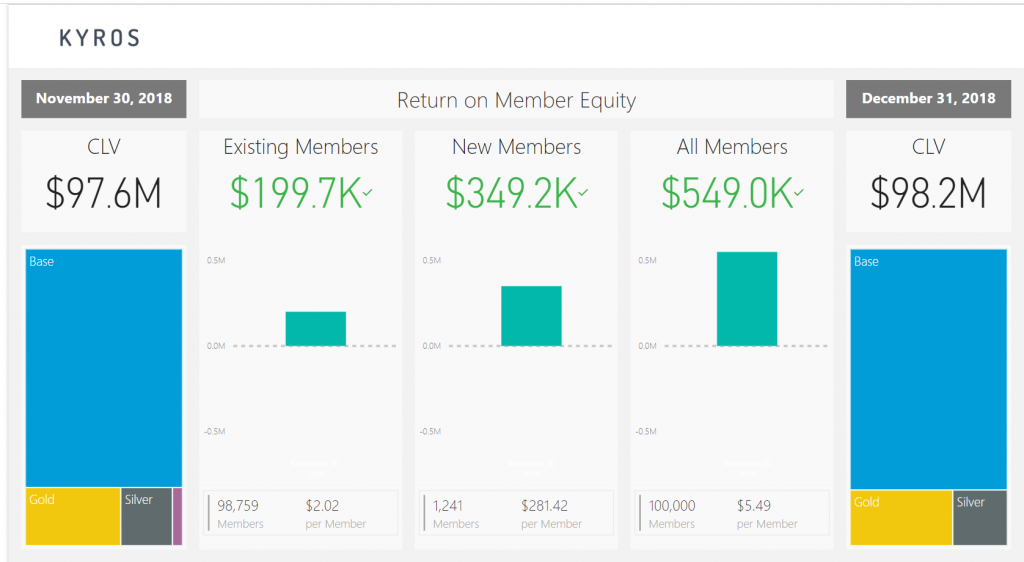

To measure the economic value of a proposed marketing initiative, you’ll need an analysis method that clearly shows the trade-off between costs and anticipated benefits — examples of which can be seen below. It’s important to note that the hypothetical loyalty program in these exhibits is relatively small, consisting of only 100,000 members. For larger programs that have millions of members, the resulting member equity projections can be on the order of several billion dollars.

Like customer-based corporate valuation models, the exhibits above show the relationship between customer future value, member equity, and return on member equity (RME) — the change in customer lifetime value over time. The goal of any marketing team should be to invest in projects that are expected to generate the highest return on member equity. By breaking RME down between current program members and new members, it’s much easier to see whether marketing is productively spending customer acquisition dollars and changing member behavior to create value for the company.

While ideally you want to see positive RME for both current and new members, detecting negative RME early can still be beneficial, as it signals a need for intervention. If marketing teams can clearly see that their efforts are diminishing company value, they can then redirect these efforts to projects that are more profitable.

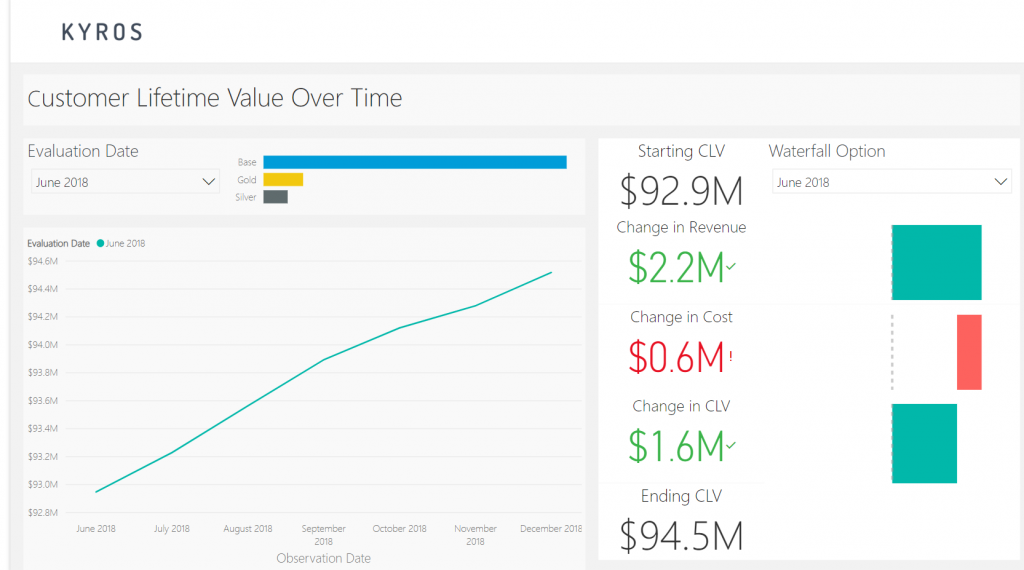

With the right set of tools, you can track member equity over time, holding the group of included members constant so that the data isn’t distorted by new member acquisitions. An increase in member equity as indicated by an upward sloping line means your RME is positive, and marketing is increasing loyalty program member value above expectations. The ability to visually demonstrate a successful long-term track record of marketing decisions that add to the economic value of the company can be very meaningful when presenting future initiatives to various stakeholders, including the shareholders of the organization.

Additionally, companies that can dig further into the components of the change in member equity over time gain a better understanding of changes in future revenue compared to changes in future cost. By seeing the cost-benefit trade-off, marketing can focus on maximizing loyalty program value instead of minimizing cost. This may lead to the execution of profitable projects that marketing would have otherwise avoided.

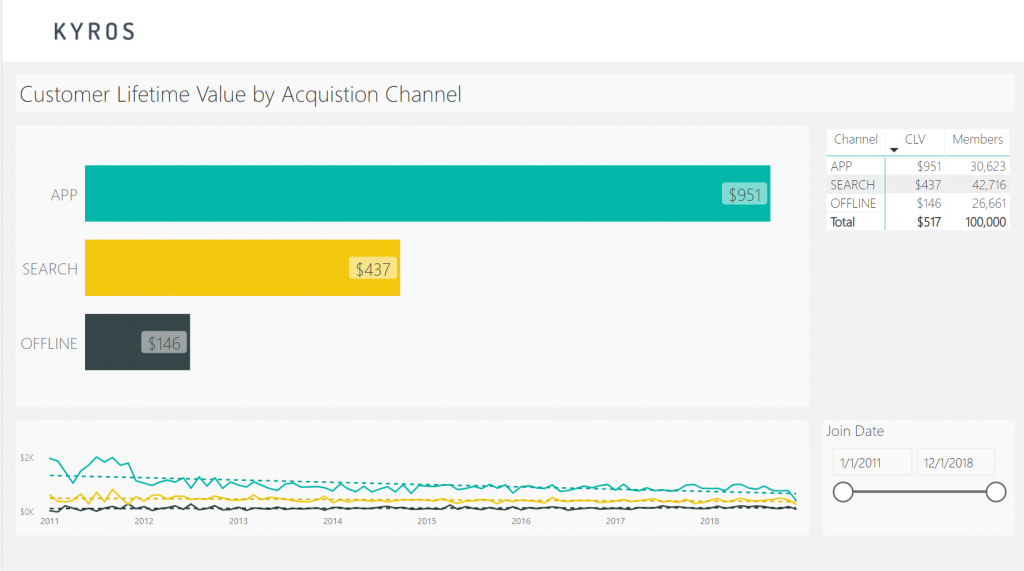

Finally, companies can measure the expected impact of their investments in acquiring new customers to develop strategies that focus on acquiring members through the channels with the highest value rather than the lowest cost. The KYROS Dashboard allows for robust customer and member equity analysis so marketing teams can validate the economic value of their efforts.

Program managers are held accountable for increasing member equity, which some companies refer to as driving incremental value. While there are various methods you can use to measure incremental value, commonly used approaches such as look-alike analysis have shortfalls that prevent you from showing a true picture of loyalty program value.

A look-alike analysis splits customers into two groups — those who join the company’s loyalty program and those who do not — and then tracks the differences in each group’s behavior over time. These differences are considered the incremental value. Unfortunately, there are two major shortfalls to this approach:

Since these shortfalls tend to result in unrealistic estimates of the program’s incremental value, companies need a better way to measure the effectiveness of program management. A different — and arguably more accurate — way to measure incremental value is by calculating return on member equity (RME). RME is similar to look-alike analysis in that it compares member behavior to a benchmark. However, the benchmark in this case is status quo member behavior — in other words, expected behavior if members continue to follow their current behavioral trend.

Status quo behavior tends to be more relevant and easier to track than the behavior of customers who choose not to join the company’s loyalty program, making it a more informative baseline. Under this framework, program managers can present more compelling proof of the economic value their loyalty program creates for the organization.

Loyalty programs are complicated engines with many moving parts that can drive company growth significantly if managed properly. A well-run loyalty program can dramatically increase the economic value of an organization as continuous investment in the right customer acquisition channels and marketing strategies drives profitability. However, to remain viable, each of the teams responsible for the program’s success—finance, marketing, and program management — must convincingly convey their value-add to senior executives, as well as the company’s shareholders.

You can only prove the value of a loyalty program if you have reliable data and the right measurement tools. Luckily, most companies already have the data they need, it simply needs to be leveraged more effectively. By employing the methods we’ve described above, you can not only measure your loyalty program’s value with more precision, you can use the insights you gain to make better decisions moving forward.

Founder and managing partner of KYROS Insights. I'm an analytics nerd and recovering actuary. I use machine learning to help loyalty programs predict member behavior so they can identify their future best customers, and recognize and reward them today.

Comments